Find out more about the REDEN Group

Having experienced sustained growth since 2008, the REDEN Group has long become a benchmark player in energy transition on an international scale

Our core business? Producing photovoltaic energy responsibly!

At REDEN, we do not only produce green electricity. We are committed to sustaining local territories, the people and their know-how, as well as the environment and its biodiversity. Our aim is to generate added value and, together with all our stakeholders, create a virtuous system in which everyone has their place and can drive a positive and naturally sustainable dynamic.

REDEN has complete mastery of the photovoltaic value chain:

- Our Engineering Office and Agro-Environment Department – comprising hydrologists, agronomic engineers, cartographers, environmental and biodiversity experts, etc. – develop tailor-made solutions for each project, integrating environmental considerations in depth, often going beyond administrative prerequisites;

- Our Development, Legal and Financing departments work hand in hand to carry out the administrative procedures (social consultation, drafting of construction leases, management of building permits, financing of power plants, etc.)

- Our industrial unit in Roquefort (France) assembles photovoltaic modules for our projects, providing us with a thorough technical knowledge;

- Our Operations division takes care of the construction, operation and maintenance of our photovoltaic electricity production units.

Founded in 2008 in the heart of Lot-et-Garonne (47) in France, REDEN has experienced strong growth on that territory and abroad

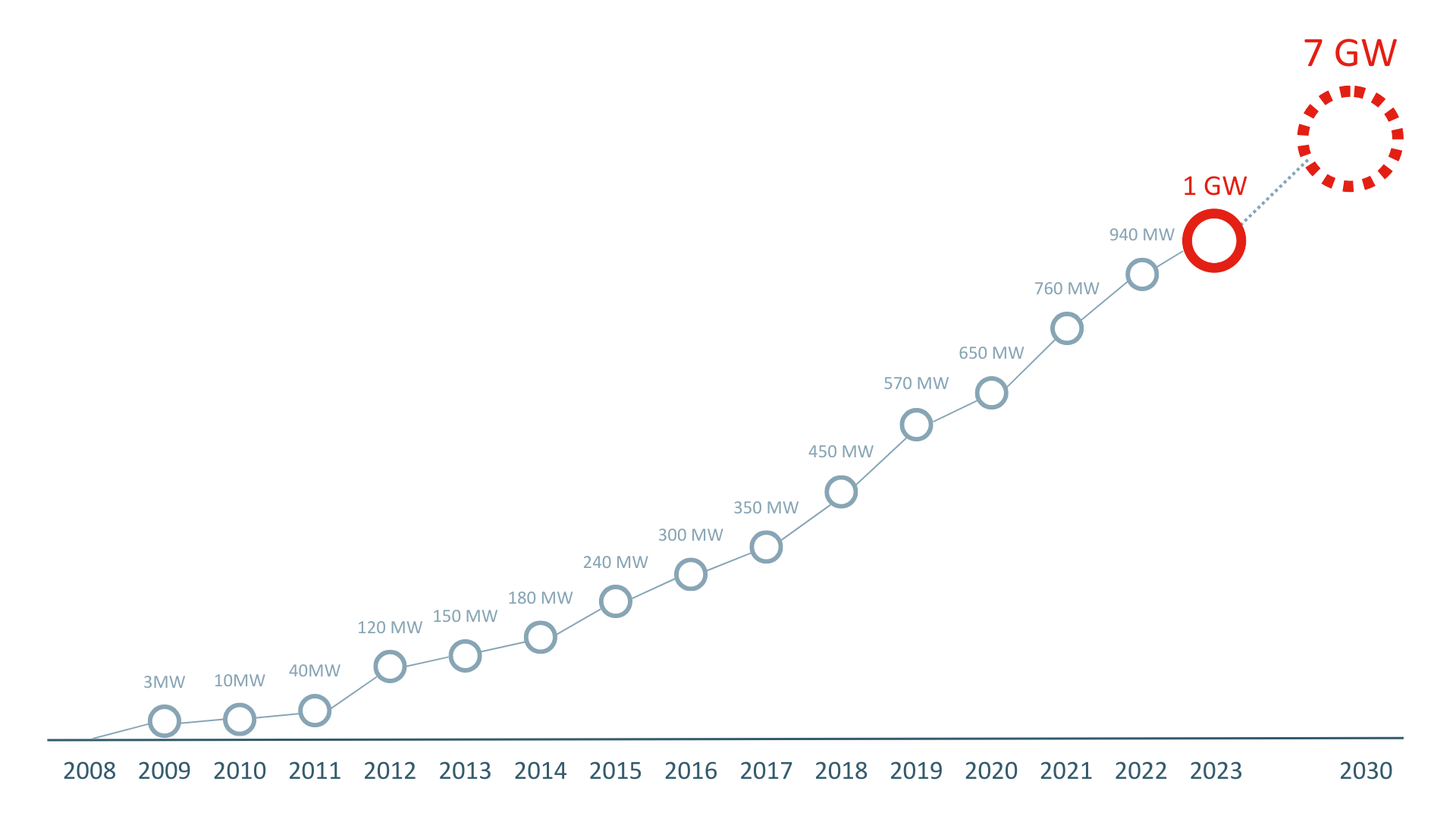

REDEN’s growth has continued to gain momentum since 2008, and the Group has now reached 1 GW in installed capacity, making it a benchmark player in energy transition.

Creation of REDEN (ex. Fonroche) in Roquefort

(South West France)

3 MW of installed capacity

Capital increase with Eurazeo & opening of our photovoltaic panel production plant in France for an integrated photovoltaic development model

10 MW of installed capacity

Opening of subsidiaries in Mexico, Puerto Rico and Colombia, and of an international office in Madrid

Activities in Kazakhstan, Ukraine and India.

40 MW of installed capacity

123 MW of installed capacity

147 MW of installed capacity

181 MW of installed capacity

240 MW of installed capacity

Divestment of projects in India and Kazakhstan

Sale of biogas and geothermal activities

300 MW of installed capacity

Fonroche’s solar subsidiary becomes REDEN Solar

Infravia acquires a stake in the company

348 MW of installed capacity

Start of operations in Spain and Portugal (51 MW), Chile (30 MW), Mexico (20 MW) and Puerto Rico (52 MW)

Acquisition of projects in Spain (50 MW) and construction of new projects in Mexico (40 MW)

Strong development of pipelines in France (2.3 GW) and Chile (0.3 GW)

450 MW of installed capacity

REDEN starts operations in Greece

573 MW of installed capacity

652 MW of installed capacity

REDEN enters the Italian market

757 MW of installed capacity

New shareholders with Macquarie, BCI and MEAG in consortium

939 MW of installed capacity

REDEN opens its German subsidiary

1 GW of installed capacity

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

OUR LOCATIONS

With its headquarters in Roquefort (47) in the south-west of France, together with branches in the French Toulouse (31), Bordeaux (33) and Nîmes (30), REDEN has offices in each country where the Group has projects in development, i.e. Spain, Portugal, Chile, Puerto Rico, Mexico, Greece, Italy and Germany.

- Headquarters & offices

- Local offices

OUR VALUES

Benevolence, Commitment, Ethics and Professionalism are the Group’s four pillars of performance, which guide us daily in all our activities.

BENEVOLENCE

Everyone within the Group acts both individually and collectively, showing respect for others, constantly improving comfort at work and promoting a working environment that is calm, enjoyable and constructive

COMMITMENT

Loyalty and involvement are key to maintaining long-term relations between our employees, the company and external partners. This is mainly why almost 100% of REDEN's employees are on permanent contracts.

ETHICS

REDEN is committed, through its activities and strategies, to acting morally and fairly at the corporate, environmental and economic level. As part of its active Social and Environmental Responsibility (SER) policy, REDEN is especially committed, through its Responsible Purchasing Charter, to maintaining a balanced relationship with its partners.

PROFESSIONALISM

REDEN’s teams are committed to working to rigorous, professional standards, developing photovoltaic projects that make sense. This value requires a constant training effort and REDEN helps its employees develop, either enhancing their skills or transitioning into new specialisations.

OUR SHAREHOLDERS

Since July 6th, 2022, a consortium with a long-term vision, comprising Macquarie Asset Management, British Columbia Investment Management Corporation (BCI) and Munich Ergo Asset Management GmbH (MEAG), has been accompanying the Group in its new growth phase.

Macquarie Asset Management

is a global asset manager,

integrated across public and

private markets. Trusted by

institutions, governments,

foundations and individuals

to manage assets, Macquarie

Asset Management provides

a diverse range of investment

solutions including real assets,

real estate, credit and equities

& multi-asset. www.macquarie.com

British Columbia Investment

Management Corporation

(BCI) is amongst the largest

institutional investors

in Canada with C$250.4

billion in gross assets under

management, as of March

31, 2024. Based in Victoria,

British Columbia, with

offices in Vancouver, New

York City, and London, U.K.,

BCI manages a portfolio of

diversified public and private

market investments. www.bci.ca

MEAG is the asset

manager of Munich Re

Group. With branches in

Europe, Asia and North

America, it also offers

its extensive know-how

to institutional investors

and private clients from

outside the company

group. MEAG currently

manages assets to the

value of around €345bn,

€61bn of which for non-

Group investors. www.meag.com